Jim Crow Museum

1010 Campus Drive

Big Rapids, MI 49307

[email protected]

(231) 591-5873

Q: I was on a virtual tour with Jim Crow Musuem staff and they mentioned that the National

Negro Business League predated the United States Chamber of Commerce. I think more

people need to know about that. Can you tell us more?

Q: I was on a virtual tour with Jim Crow Musuem staff and they mentioned that the National

Negro Business League predated the United States Chamber of Commerce. I think more

people need to know about that. Can you tell us more?

~ Donna K.

Lansing, Michigan

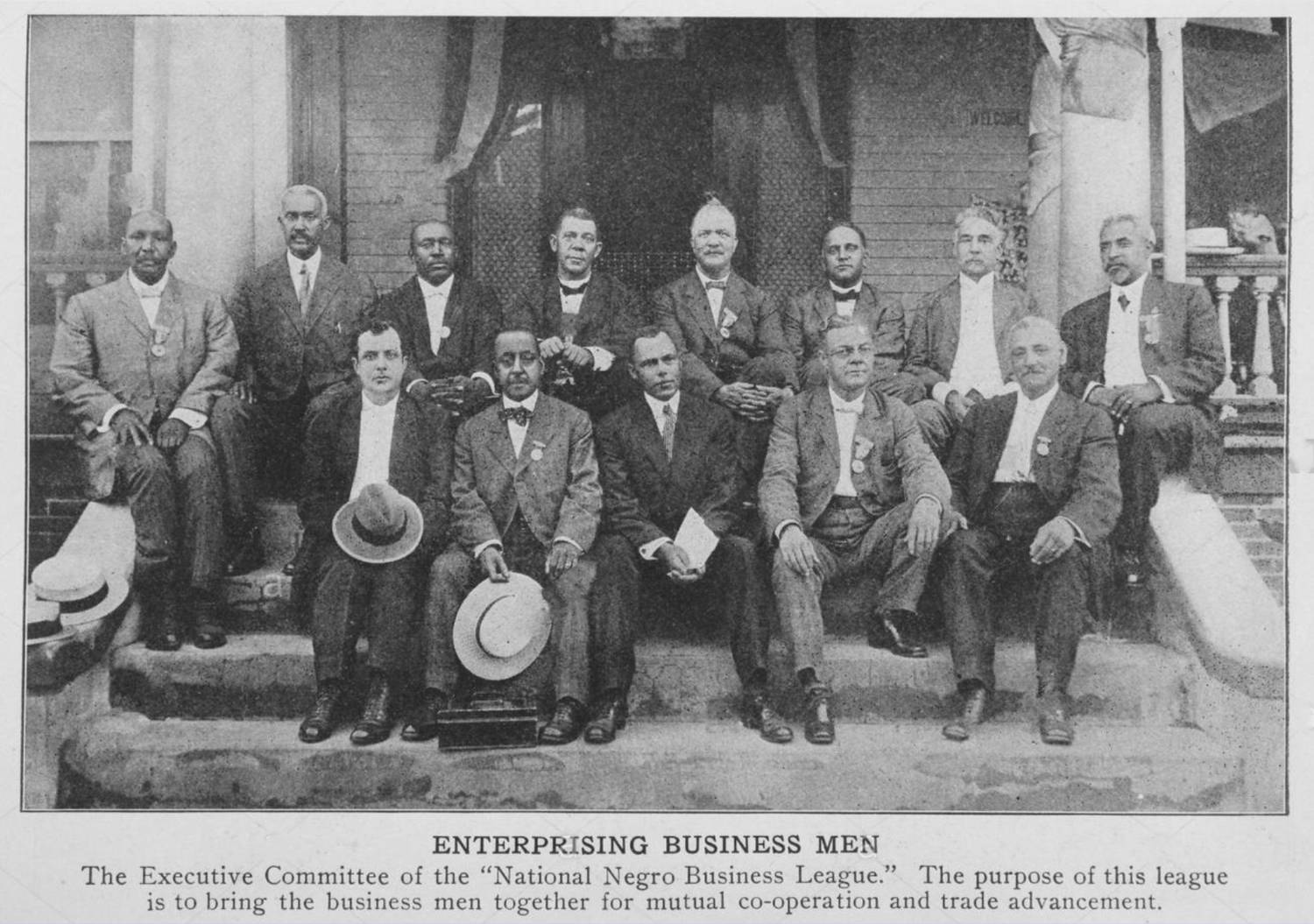

A: Despite facing discrimination and systemic barriers restricting access to entrepreneurial

opportunities, Black people made significant contributions to business practices that

enriched communities across the United States. The National Negro Business League (NNBL) was founded by Booker T. Washington in Boston, Massachusetts in 1900, and became the largest association of Black business-people and professionals

in the country. The league, which predated the United States Chamber of Commerce by

12 years, strives to enhance the commercial and economic prosperity of the African

American community. In 1966, the National Negro Business League was reincorporated

in Washington, D.C. and renamed the National Business League. Woodbridge Ferris, the founder of Ferris

Institute, had a collegial relationship with Booker T. Washington. Washington spoke

at Ferris in 1902, and some prominent members of the NNBL sent their sons to Ferris

for business degrees.

The NNBL operated conventions in many cities that brought together Black-business owners to highlight the work being done locally and nationally.; The NNBL conventions helped participants to establish broader business connections and to inspire more African Americans to support ongoing efforts and startup businesses of their own. Each convention featured speakers, provided information about the local Black-businesses, had an illustrated program outlining the history of Black-business before the NNBL, and advertisements of local Black-owned businesses. Two financial companies, the National Negro Finance Corporation (NNFC) and the Allied Industrial Finance Corporation grew out of the National Negro Business League, inspiring a rivalry and ambitious goals for each company. The Universal Negro Improvement Association (UNIA) founded by Marcus Garvey also advocated for Black community investment and raised millions of dollars to support UNIA programs, businesses, and development projects.

It took courage and resilience for African Americans to endure daily discrimination. The need for the establishment of Black businesses increased with segregation because many white businesses refused to serve Black customers. Black-owned businesses provided a wealth of services, safe customer assistance, were located in Black neighborhoods, and formed the heart of many communities. Black churches, organizations, and clubs offered support and protection, and the NAACP provided legal assistance. Most businesses were local, small-scale, and family run due to barriers in finding financial backers, loans, and property for rent or purchase.

The need for the National Negro Business League and Black-owned financial institutions was critical. Jim Crow legislation restricted access to white-owned financial services and banking options, causing African American business owners to seek alternative options for financing, credit, or to seek out Black-owned banking institutions. Black banks served as a source of credit for businesses and consumers, provided training opportunities and jobs for African Americans, supported economic development and businesses in communities, and were a shelter from discriminatory Jim Crow practices. Jim Crow influenced the ability for Black people to receive fair pay, benefits, and build wealth, due to discriminatory systems of hiring and restrictive housing practices and like redlining. Despite these conditions Black businesses flourished, expanding opportunities and encouraging safer spaces to conduct business and to socialize. They also established a sense of solidarity and pride within Black neighborhoods and served as symbols of racial progress.

Jennifer Hasso

Jim Crow Museum

2021

Resources

Braden, D. R. (n.d.). Black Entrepreneurs during the Jim Crow Era -- The Henry Ford Blog - Blog. The Henry Ford. https://www.thehenryford.org/explore/blog/black-entrepreneurs-during-the-jim-crow-era

Driskell, J. (2017, January 4). Freedom's tally: An African American business in the Jim Crow South. National Museum of American History. https://americanhistory.si.edu/blog/freedoms-tally-african-american-business-jim-crow-south

Todd, T. (2020, December 11). Let Us Put Our Money Together: The Founding of America's First Black Banks. Federal Reserve Bank of Kansas City. https://www.kansascityfed.org/about-us/let-us-put-our-money-together-founding-americas-first-black-banks/

Charles Gerena, 2007. Economic history : Opening the vault, Econ Focus, Federal Reserve Bank of Richmond, vol. 11(Spr), pages 46-49. https://www.ebony.com/wp-content/uploads/2016/08/economic_history.pdf

Fulfer, J. (2021, February 7). How A Black Owned Bank Redefined Risk. The Economic Historian.

https://economic-historian.com/2020/11/black-owned-banks-redefined-risk/